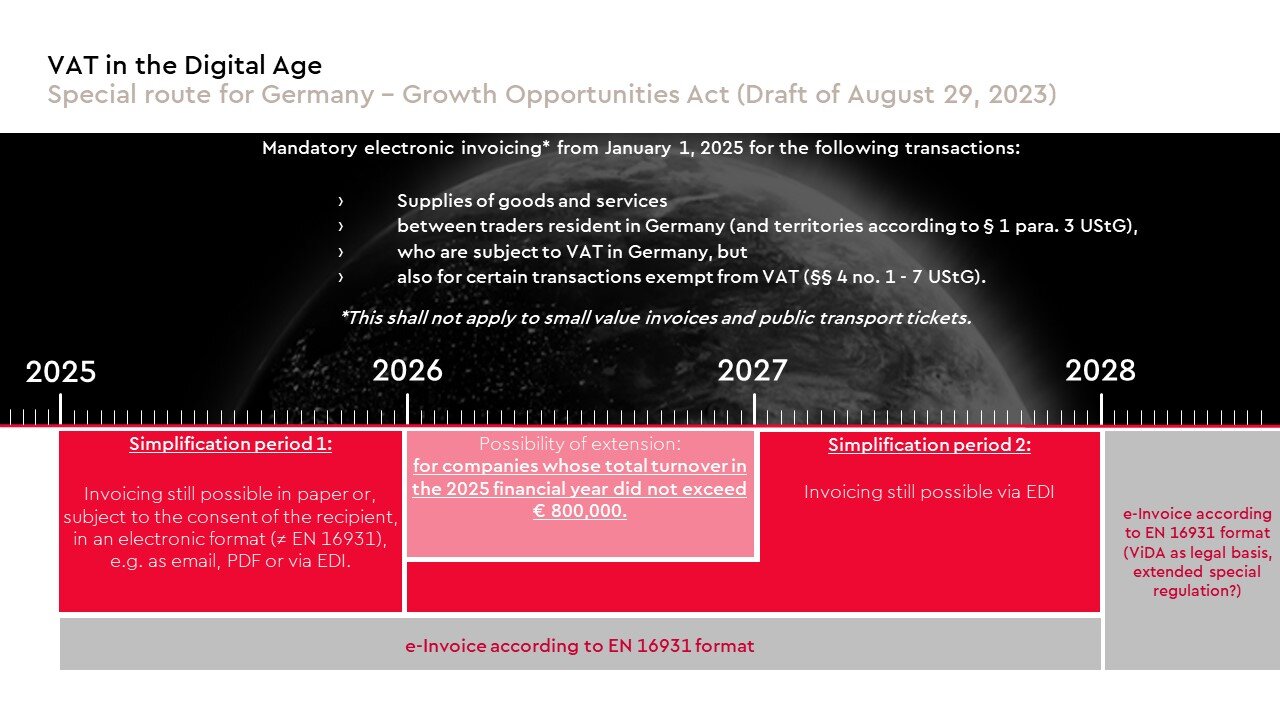

The draft of the Growth Opportunities Act (Wachstumschancengesetz) provides for the mandatory use of electronic invoices from January 1, 2025 for certain circumstances. The core elements of the planned changes to invoicing are:

- the definition of the term “e-Invoice” in line with the ViDA bill, i.e. an invoice that must compulsorily comply with the requirements of CEN standard EN 16931 (Directive 2014/55/EU of 16.04.2014); thus, the draft reverts to the data format that is already used for electronic invoices in the B2G area through ZUGFeRD and XInvoice,

- the deletion of the priority of paper invoices in Sec. 14 para. 1 sentence 7 German VAT Act,

- the obligatory issuing of an e-Invoice for B2B transactions taxable in Germany (except for certain tax-exempt transactions) if the supplier and the recipient of the service are deemed to be resident in Germany,

- the possibility to use e-Invoices or “other invoices” in electronic form also in the B2C sector (however, only with the consent of the recipient)

The bill also contains transitional regulations for the introduction of electronic invoicing: Until December 31, 2025 taxpayers shall be allowed to use other forms of invoicing than electronic invoicing, e.g. in paper format. For transactions carried out in the years 2026 and 2027 it shall also remain possible to continue invoicing by using the EDI procedure instead of electronic invoicing until December 31, 2027.

In a letter dated October 2, 2023 addressed to the trade associations, the tax authorities commented on the planned changes to the issuing of invoices pursuant to Section 14 German VAT Act. With regard to the question of which invoice formats can be regarded as structured electronic invoices under this regulation, the Federal Ministry of Finance and the highest tax authorities of the federal states are of the opinion that in particular both invoices according to the XStandard (so-called XInvoice) and those according to the ZUGFeRD format (from version 2.0.1) should in principle meet the planned requirements. In addition, the letter provides further details on the future handling of hybrid invoice formats (e.g. an invoice in ZUGFeRD format, which simultaneously contains a pdf document and a data record in XML format). From the expected introduction of the mandatory electronic invoice on January 1, 2025, the structured part is to be decisive for these invoice formats, in contrast to the current provisions. In the event of differing information in the two elements, the data from the structured part (the XML file) should then take precedence over that from the image file (the PDF document). The tax authorities also explicitly clarify that the basic permissibility of a hybrid format should not change. With regard to the possibility, limited until December 31, 2027 according to the provisions of the planned Growth Opportunities Act, of also being able to use the EDI procedure instead of the mandatory electronic invoice, the tax authorities are aware of the importance of this invoicing format for certain areas of the economy. Therefore, a solution is already being worked on to ensure the continued use of EDI procedures as far as possible under the future legal framework. However, it cannot be completely ruled out that technical adaptations to certain EDI procedures may still become necessary with the introduction of the transaction-based reporting system. By way of clarification, the tax authorities state that according to the government draft of the Growth Opportunities Act, the receipt of an electronic invoice will be mandatory for all domestic entrepreneurs as of January 1, 2025. The transitional regulations provided for in the draft only concern the manner of issuing an invoice in other formats. If the invoice issuer decides to use an electronic invoice, the invoice recipient would therefore also have to accept it.

Digitalisation can make a decisive contribution to simplifying procedural processes, e.g., automatic invoice processing without media discontinuity. However, the planned digitalisation of invoicing for VAT purposes is associated with far-reaching changes to processes. The regular publications by the tax authorities make it clear that they also expect massive conversion requirements and adjustments. Taxpayers are recommended to get an overview as quickly as possible of wthat adjustments are required in their IT-landscape in order to meet the planned changes.